Investing in Biodiversity

Climate, biodiversity, and economies are inextricably linked. Half of global GDP, $44 trillion, is heavily dependent on nature’s ecosystem services —such as pollination, providing water, or growing timber. A healthy natural environment contributes to healthy people and healthy businesses. However, human activities are decreasing the planet’s biodiversity. To protect Earth’s wide variety of animals, plants, birds and aquatic species, we must change the way we produce and consume. The Global Biodiversity Framework estimates the gap in financing for biodiversity at $700 billion per year between now and 2030.

Climate, biodiversity, and economies are inextricably linked. Half of global GDP, $44 trillion, is heavily dependent on nature’s ecosystem services —such as pollination, providing water, or growing timber. A healthy natural environment contributes to healthy people and healthy businesses. However, human activities are decreasing the planet’s biodiversity. To protect Earth’s wide variety of animals, plants, birds and aquatic species, we must change the way we produce and consume. The Global Biodiversity Framework estimates the gap in financing for biodiversity at $700 billion per year between now and 2030.

IFC’s Green Banking Academy (GBAC) is an online banking knowledge initiative designed to help financial institutions and the private sector in Europe and Central Asia (ECA) learn about how financial institutions can make positive contributions to the Earth’s climate, such as supporting biodiversity. GBAC advisory services are available to help financial institutions gain this knowledge. IFC offers the tools that financial institutions will need to measure, report on, and decrease GHG emissions in their portfolios. IFC can also assist financial institutions in developing new financial instruments that specifically support biodiversity.

“The rapid decline in biodiversity and ecosystem degradation has enormous development, economic, and financial costs. We cannot overstate the importance of mobilizing more funding, and particularly private finance, to reverse this loss.”

Juergen Voegele

Vice President for Sustainable Development, World Bank

The UN Convention on Biodiversity

The United Nations Convention on Biological Diversity (CBD) was adopted in 1992 at the United Nations’ Conference on Environment and Development, the “Earth Summit” held in Rio, Brazil. At that time, 150 countries signed the Convention, now 196 countries are taking part. The Convention’s definition of “biodiversity” includes variability among all living organisms, on land or in water. This includes diversity within species, between species, and of ecosystems.

The Convention recognizes that protecting biological diversity is in our self-interest. Losing biodiversity threatens our food supplies, our opportunities for recreation and tourism, and our sources of wood, energy, and medicines. In recent years, the UN reports that species have been disappearing at 50 to 100 times that natural rate; this rate of change is expected to rise. Based on current trends, the UN estimates that 34,000 plant species, 52,000 animal species, and one-in-eight birds face extinction.

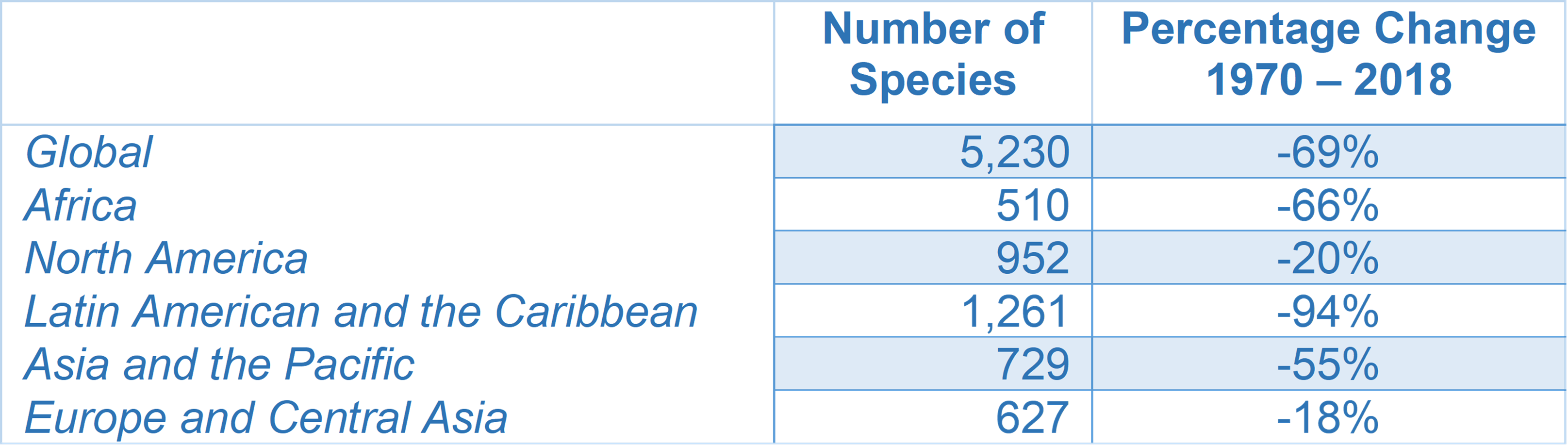

Member countries of the Convention have set biodiversity targets. Several statistical measures have been developed to measure progress toward these goals. One of these measures is the Living Planet Index (LPI), managed by the World Wildlife Fund (WWF) and the Zoological Society of London (ZSL). The LPI index is a statistical measurement of biodiversity among vertebrates — animals that have a backbone and a skeleton.

The LPI can be viewed as an annual report on global biodiversity. The 2022 LPI reports a 69 percent decrease in biodiversity between 1969 and 2018. This includes wildlife populations on land, in freshwater, and in oceans — in total, 5,230 wildlife species around the globe. The LPI for Europe and Central Asia is less disturbing, but still concerning. The LPI for this region shows a decline of 18 percent from 1970 to 2018. The largest decline in biodiversity is seen in Latin America and the Caribbean, as shown in Table 1.

Table 1: Changes in Biodiversity, 1970 to 2018

Source: 2022 Living Planet Report

“The Living Planet Index highlights how we have cut away the very foundation of life and the situation continues to worsen. Half of the global economy and billions of people are directly reliant on nature.”

Dr. Andrew Terry

Director of Conservation and Policy, Zoological Society of London

Biodiversity COP 15, Montreal 2022

The 15th Conference of the Parties on Biodiversity was held in Montréal, Canada, in December 2022. At COP 15, participants agreed to the Kunming-Montréal Global Biodiversity Framework, a plan that includes four goals and 23 targets to be achieved by 2030. The plan also includes a goal of protecting 30 percent of the world’s land and 30 percent of its oceans by 2030 (known as “30 x 30”).

The COP 15 term goals contribute to the 2050 Vision for Biodiversity, a vision of a world living in harmony with nature where, “By 2050, biodiversity is valued, conserved, restored and wisely used, maintaining ecosystem services, sustaining a healthy planet and delivering benefits for all people.” These four goals include: halting human-induced extinction and reducing the rates of extinction; managing biodiversity to ensure that nature’s contributions are valued and enhanced; sharing benefits from the use of genetic resources fairly; and ensuring all parties have adequate means to implemented the Framework.

A key outcome of COP15 was the development of a new biodiversity fund within the Global Environmental Facility (GEF) that will finance $30 billion annually for biodiversity by 2030.

“Our future is tied to biodiversity. If nothing changes, we will lose life-sustaining plants, animals, and micro-organisms. The livelihoods of many communities are at risk. The sheer magnitude of the challenges before us demand a multilateral response. Today’s commitment to scale up international financing for biodiversity is much welcomed.”

Jutta Urpilainen,

European Commission, Commissioner for International Partnerships

Biodiversity Finance

Biodiversity finance is a growing area of green finance. Biodiversity finance projects help protect, maintain, or enhance biodiversity and ecosystem services, as well as promote the sustainable management of natural resources. Existing Green Bond Principles and Green Loan Principles include “biodiversity” as a valid use of proceeds.

To provide more detailed information about which investments qualify as biodiversity finance, IFC has developed a Reference Guide to Biodiversity Finance. The Guide lists five key criteria that investments must meet to qualify for green finance.

- The project must be consistent with the Green Bond or Green Loan Principles’ eligible categories, and consistent with the United Nation’s Sustainable Development Goals (SDGs) 14 and 15, where SDG 14 is “Conserve and sustainable use the oceans, seas and marine resources for sustainable development,” and SDG 15 is “Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss.”

- The project must not introduce risk that may affect progress on other environmental priorities such as SDG 2 (zero hunger), SDG 6 (clean water and sanitation), SDG 7 (affordable and clean energy), SDG 12 (responsible consumption and production), and SDG 13 (climate action).

- If there are material environmental and social risks, environmental, governance and social goals (ESGs) must be applied.

- The project must address one of the key drivers of biodiversity loss. There are several eligible drivers including land- and sea-use change, such as transition to agriculture that results in habitat loss; overexploitation and unsustainable use of nature; pollution; invasive species; and climate change.

- The project must have metrics to determine and measure its impacts on biodiversity.

“In a sign of a fast-growing biodiversity finance market, last year assets in biodiversity-related funds tripped in one year to reach $1 billion.”

Irina Likhachova,

Biodiversity Finance Lead, IFC

The Finance for Diversity Foundation is a group of financial institutions promoting action on biodiversity. The Foundation encourages financial institutions to sign its “Finance for Biodiversity Pledge.” The Pledge is a commitment to: collaborate and share knowledge, engage with companies, assess biodiversity impact, set biodiversity targets, and report publicly on this work before 2025. To date, 126 financial institutions from 26 countries have signed the Pledge.

Potential Biodiversity Projects

As with green bonds and loans, it is important to ensure that the proceeds from the bonds or loans are used in ways that are eligible as biodiversity projects. In its Reference Guide to Biodiversity Finance, IFC lists three eligible categories. Each of these categories include a wide range of potential investments.

Category 1: Activities that seek biodiversity co-benefits. These projects address one or more drivers of biodiversity loss, even though biodiversity is not a primary objective. Examples of eligible projects in this category include:

- Rewilding by creating and restoring habitats for wildlife;

- Sustainable aquaculture production;

- Nature-based solutions for waste-water treatment;

- Flood mitigation activities that prevent plastic, waste or pollutant runoff;

- Agroforestry systems; or,

- Ecotourism ventures.

Category 2: Investments that promote biodiversity conservation as a primary objective. Some eligible projects in this category include:

- Rewilding through creating and restoring habitats for wildlife;

- Programs that finance management and intervention that reduce fire threats;

- Conservation and creation of wetlands; and,

- Conservation of marine areas.

Category 3: Investments in nature-based solutions to conserve, enhance, and restore ecosystems and biodiversity. This includes projects like:

- Natural infrastructure to reduce temperatures of used water discharged into waterways;

- Constructed wetlands for water treatment;

- Conserving coral reefs to reduce storm surges and flooding; and,

- Nature-based solutions for solar farms to cool solar panels and enhance their performance.

Once projects have been selected for biodiversity financing, it is important to develop a method of reporting results. This will include choosing appropriate data, collecting data, and disclosing information about the project’s impact.

Start Your Green Journey

For more information about GBAC or to schedule an assessment of your climate capabilities, please email ecagbac@ifc.org to contact a member of our ECA GBAC team. We are looking forward to working with you. Stay green!