ClimaLAB: Steering Financial Institutions Towards the Green Transition

From 1980 to 2022, climate-related disasters caused losses of €650 billion across Europe, around €15.5 billion per year. According to a World Bank study, after severe climate and environmental disaster episodes non-performing loan (NPL) ratios increase by 0.37 percentage points.

The European Central Bank is encouraging banks in the region to integrate climate risk in their decision-making process, and to focus on managing climate risks in their loan portfolios while financing sustainable initiatives.

In partnership with the government of the Netherlands, IFC has launched ClimaLAB, an online learning accelerator, to help financial institutions build robust climate risk management plans. ClimaLAB offers climate-focused training designed to help banks build capacity in climate risk assessment and management, and understand how to integrate climate and sustainability measures into their business operations.

ClimaLAB enables financial institutions to develop the skills necessary to assess the impact of climate risks on their portfolios, explore opportunities for sustainable investments, and design robust strategies for transformation.

“Through ClimaLAB, we aim to empower banks and other financial institutions to not only navigate the complexities of climate risk but also seize the opportunities that arise from the transition to a low-carbon economy.”

Liliana Pozzo, IFC Sustainable Finance Advisory Services Manager, Latin America and the Caribbean and Europe

Climate Risks

Climate change adds two key risks to the economy: physical risks and transition risks. Financial institutions’ clients are subject to both of these risk types.

Physical risks are the tangible risks caused by climate change. This includes the effects of extreme weather events and the long-term effects of climate change. Physical risks affect property, infrastructure, and land. For example, a company’s production facility may be in an area at risk of flooding. This company is at risk of a significant flood that impacts corporate profits. Or, consider a retail business with a storage warehouse in an area at risk of wildfires. This business is at risk of hot, windy weather that spreads fire that destroys inventory.

Transition risks arise from shifts in climate policy, technological advancements, and changes in consumer and market behavior as the economy adapts to a lower-carbon future. For example, producers of old technologies are at risk of being replaced by new technologies. Manufacturers of gas-powered cars may lose sales to companies making electric cars. Companies that do not transition to low-carbon practices may lose customers to other companies that are perceived as “more green.” Companies are also at risk of not meeting climate-related reporting requirements.

Exposures to these risks can differ greatly between countries. Generally, lower- and middle-income economies are more susceptible to physical risks, due to infrastructure that does not meet the standards required for a changing climate. Financial institutions must understand their clients’ exposure to both physical and transition risks.

“Disregarding the implications of climate change can generate significant risks for the financial sector. Losses can arise from both direct damage and from the effects that potentially higher maintenance costs, disruption and lower labour productivity could have on profitability and hence default risk.“

Christine Lagarde, President of the European Central Bank

Climate Risk and Regulatory Requirements

Financial sector supervisors and regulators play a crucial role in addressing climate risks. They need to actively monitor, assess, and mitigate climate-related risks. This includes conducting climate stress tests and understanding green finance taxonomies. With these measures, the financial sector can adapt to climate change and transition towards sustainable investment practices.

The impacts of climate change projected for Europe have sparked a call for urgent action to improve resilience. The European Union regulatory framework encourages banks to integrate climate risk into their decision-making and focus on managing climate risks in their loan portfolios while financing sustainable initiatives.

With its advanced climate and sustainability regulations, the EU serves as a role model for other regions and for developing countries. The EU has adopted comprehensive standards for companies and financial institutions with respect to climate change mitigation and adaptation, as well as measuring and reporting standards.

Financial institutions in non-EU member countries are also coming under pressure from local regulators to integrate climate risk in their decision-making. In some cases, businesses in non-EU countries must also meet EU standards. For example, businesses in non-EU countries may be segments of the value chains of EU-based companies. In this case, the non-EU businesses must become compliant with EU regulations to ensuring seamless operations and partnerships.

Financial institutions that adopt a long-term approach to managing climate risk in alignment with EU regulations can attract a broader range of investors. Incorporating climate risk into standard business practices demonstrates a commitment to sustainability, a willingness to combat climate change, and a reduction of climate risks.

Developing Expertise in Climate Risk Management

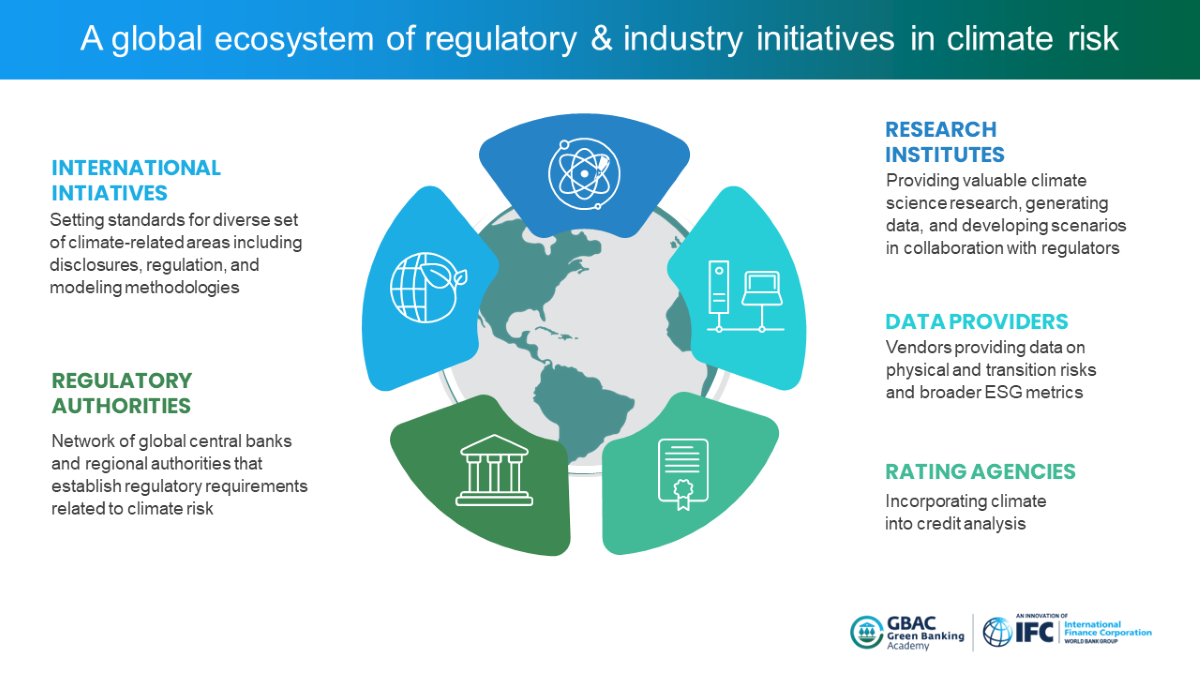

As the following graphic indicates, many corporations, organizations, and regulatory agencies are part of the global climate risk ecosystem. Each financial institution must understand which standards, initiatives and authorities are relevant to their own climate risk assessment.

Figure 1: The global ecosystem of the regulatory and industry initiatives in climate risk

Source: IFC

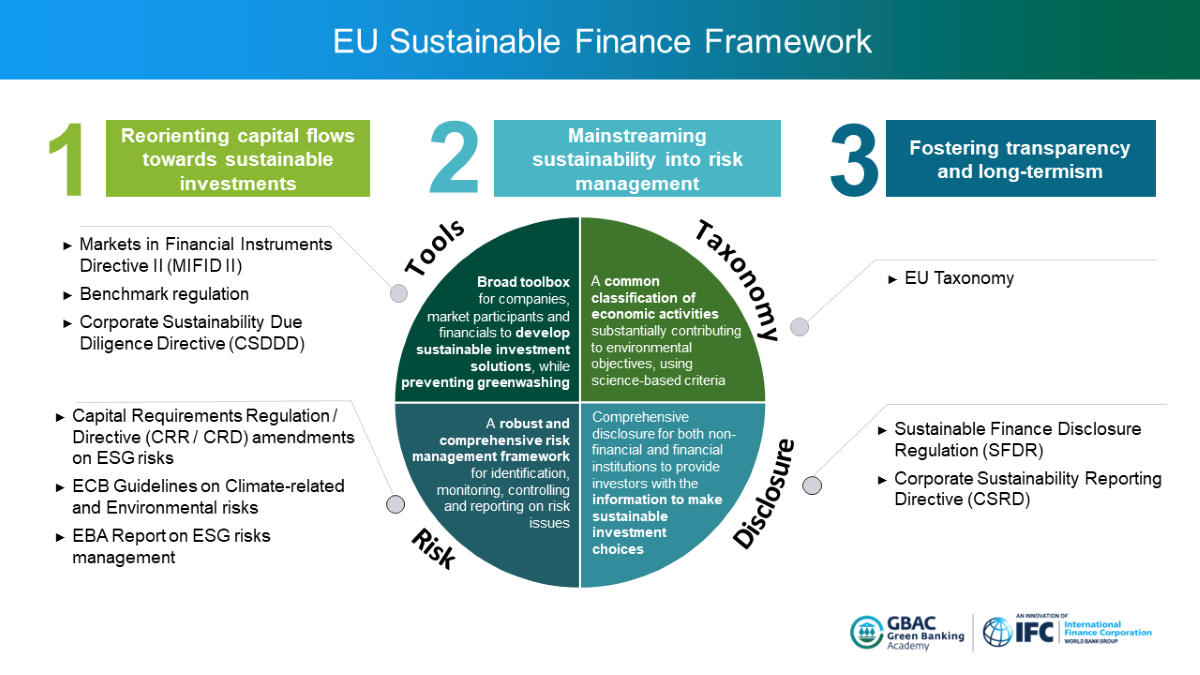

While banks in the EU-member countries must conform to the EU’s regulations and requirements, banks in non-member countries must also become familiar with these standards. The key components of the EU sustainable finance framework are shown in the following graphic. Banks in the EU will need to use the EU taxonomy to assess climate risks before they can meet disclosure requirements.

Figure 2: The EU Sustainable Finance Framework

Source: IFC

However, as interconnected regulations, requirements, guidelines, and taxonomies continue to evolve, it can be difficult for financial institutions to define priorities and develop strategies.

How ClimaLAB Can Help

ClimaLAB is designed to help financial institutions build a robust climate risk management roadmap as well as a transition plan roadmap.

ClimaLAB is a two-month program delivered online. Participants work together in cohort groups to develop the knowledge and skills necessary to understand and manage climate risk in their banks’ loan portfolios. In addition, participants explore opportunities for sustainable investments and design strategies for their banks’ transition to net-zero.

The program is open to banks in the European countries where IFC operates, including countries in the Western Balkans, South Caucasus, Bulgaria, Croatia, Moldova, Poland, Romania, and Ukraine, as well as subsidiaries of banks headquartered elsewhere in Europe.

Developed by IFC and Management Solutions, an international business consulting firm, ClimaLAB helps financial institutions assess climate-related risks, incorporate these risks into the required disclosure and sustainability reports and, ultimately, develop transition and adaptation strategies aligned with regulatory expectations.

ClimaLAB provides practical exercises and hands-on tools for climate risk assessment. Participants can apply these tools to their banks’ loan portfolios. This practical approach provides participants with a new perspective on their portfolio, helping uncover new opportunities for sustainable investments and better address climate risks.

The bank managers who participated in the ClimaLAB pilot cohort reported that the training program was comprehensive and provided a strong foundation in climate risk principles. The new knowledge and skills helped participants identify and tackle the gaps in their understanding of climate-related risks and the impacts of those risks on their banks’ operations. Participants particularly appreciated the practical tools included in the program, and said that ClimaLAB is directly applicable to their actual work.

Financial institutions interested in participating in the ClimaLAB training program, can submit their applications to climalab@ifc.org.

Start Your Green Journey

Experts from the IFC Green Banking Academy (GBAC) are available to provide you with more information about the available knowledge and resources to improve your financial institution’s capacity in climate risk management. For more information about GBAC, or to schedule an assessment of your climate risk management capabilities, please email ecagbac@ifc.org to contact a member of our ECA GBAC team. We are looking forward to working with you. Stay green!